Personal Injury Loans: Fast Cash Advances for Your Settlement

When You’ve Been Wronged, It’s Your Right to Make It Right!

Pre-Settlement Funding is all about ensuring you feel safe and supported during this time.

We offer you the financial support needed to cover essential expenses so you can concentrate on your recovery and legal case without added stress.

Are mounting medical bills and living expenses putting pressure on you while waiting for your personal injury settlement? DiamondBack Funding provides fast, risk-free pre-settlement funding to help you maintain financial stability during your legal battle. Our personal injury loans are structured as non-recourse cash advances, meaning you only pay back if you win your case.

Get the financial support you need within 24-48 hours upon approval – with no credit checks, no monthly payments, and no obligation to repay if you lose your case. Don’t let insurance companies pressure you into accepting a lowball settlement when you could get cash now to cover your immediate needs.

What are Personal Injury Loans?

Personal injury loans, technically structured as pre-settlement funding advances, provide immediate access to a portion of your expected lawsuit settlement while your personal injury case is pending. Unlike traditional loan companies, our legal funding doesn’t require monthly payments or credit approval.

This innovative personal injury funding solution helps accident victims bridge the financial gap between their injury and final settlement. When you’re dealing with medical expenses, lost wages, and living expenses, a pre-settlement loan can provide the breathing room you need to pursue full compensation.

Key Benefits of Personal Injury Funding

Our lawsuit funding offers unique advantages over traditional financing:

• No Credit Checks Required – Your injury claim’s strength matters, not your credit score

• No Monthly Payments – Unlike conventional loans, there are no recurring payment obligations

• Non-Recourse Structure – You only pay back if your personal injury lawsuit succeeds

• Fast Approval Process – Most funding applications are approved within hours

• Flexible Use – Use your cash advance for any expenses you need

• No Employment Verification – Your injury case merit determines approval

How Personal Injury Settlement Advances Work

The process is straightforward. After you submit your funding application, our team reviews your personal injury claim with your personal injury attorney. If your accident lawsuit shows strong potential for a favorable lawsuit settlement, we provide immediate cash advances against your future recovery.

When your case settles, the funding amount plus fees are deducted from your personal injury settlement. If you lose your case, you owe nothing – that’s the power of non-recourse legal funding.

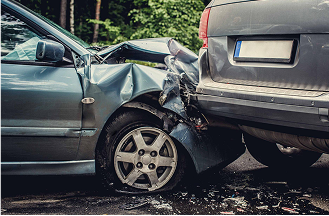

ACCIDENTS LAWSUITS & LIABILITY CLAIMS

Protect Your Rights, Secure Your Future

Accidents occur instantly, but their impact lasts a lifetime.

Negligence by others enables victims to pursue compensation through lawsuits and liability claims.

Legal actions help injured individuals secure compensation for medical costs, lost wages, and pain. However, insurance companies often delay or dispute claims, highlighting the need for strong legal representation to ensure fair outcomes.

Why You Need a Lawyer?

Filing a personal injury lawsuit requires legal expertise. An attorney helps:

Prove liability

Establishing who is at fault and collecting the necessary evidence.

Negotiate with insurance companies

Insurers often delay or minimize settlements to protect their profits.

Fight for maximum compensation

Your case shapes your eligibility, not your score.

We are the clear choice

Not all pre-settlement funding companies operate with your best interest in mind.

While many focus on quick cash advances, we prioritize fairness, transparency, and a process designed for your peace of mind. Unlike others, we:

- Offer low, transparent rates with no hidden fees.

- Provide non-recourse funding, meaning you only repay if you win your case.

- Approve funding quickly, often within 24 hours.

- Work directly with your attorney to ensure a seamless experience.

When life takes a wrong turn, we help you get back on track

We offer pre-settlement funding for personal injury claims, helping plaintiffs stay financially secure as they wait for a fair settlement.

Funding allocated for various types of cases, including:

Funding allocated for various

types of cases, including:

Motor Vehicle Accidents

Show more

Pre-settlement funding for personal injury cases provides immediate financial relief, covering essential expenses, rent, and even medical treatments.

With financial stability, injured drivers and passengers can focus on recovery while their legal team fights for fair compensation without pressure to accept low settlement offers.

Slip & Fall & Premises Liability

Show more

Premises liability cases involve intricate legal disputes that require proving negligence.

Cash advances for slip and fall lawsuits provide financial assistance during resolution. This support alleviates financial strain, allowing injured victims to seek justice without the pressure of settling prematurely due to financial concerns.

Workplace & Construction Accidents

Show more

Workplace accident funding helps injured employees stay financially stable while their legal case progresses. Covering expenses and daily necessities, this support ensures that victims can recover without the added pressure of mounting bills. Since repayment is only required if the case is won, applicants can focus on their health and legal rights with peace of mind.

Take the first step toward financial relief—apply now!

Types of Personal Injury Cases We Fund

Our lawsuit funding companies specialize in various personal injury claims and injury lawsuits. We provide pre-settlement funding offers for:

Motor Vehicle Accidents

Car accident cases often involve significant medical bills and lost income. Our personal injury loan options help cover immediate expenses while your attorney negotiates with insurance companies for fair compensation.

Slip and Fall Incidents

Premises liability cases can take months to resolve. Pre settlement funding helps cover medical expenses and living expenses during the legal process.

Medical Malpractice Claims

These complex personal injury cases often require extensive expert testimony and lengthy litigation. Our injury lawsuit funding provides financial stability throughout the process.

Workplace Injuries

When workers’ compensation isn’t sufficient, a personal injury claim may be necessary. Our settlement loans bridge the gap between injury and resolution.

Product Liability Cases

Defective product injuries can result in substantial settlements, but these cases take time to develop. Get cash now while building your strongest possible claim.

Wrongful Death Claims

Families facing wrongful death lawsuits often struggle with funeral expenses and lost income. Our legal funding provides immediate financial relief during this difficult time.

Construction Accidents

Construction site injuries frequently involve multiple liable parties and complex litigation. Our lawsuit funding company provides support throughout the legal process.

Who Qualifies for Pre-Settlement Funding?

You may qualify for our personal injury funding if you meet these basic criteria:

Essential Requirements

An active personal injury lawsuit filed with the court

Legal representation by a qualified personal injury attorney working on contingency

Clear liability showing the defendant’s fault in your injury case

Sufficient anticipated settlement value to support the advance amount

Case Strength Evaluation

Our lawsuit funding companies evaluate several factors when reviewing pre-settlement funding offers:

Liability Assessment – How clear is the defendant’s responsibility for your injuries?

Damages Documentation – Are your medical bills and other losses well-documented?

Insurance Coverage – Does the defendant have adequate insurance or assets?

Attorney Quality – Is your personal injury attorney experienced with similar cases?

No Traditional Loan Requirements

Unlike conventional loan companies, we don’t require:

– Good credit scores or credit history

– Employment verification or income documentation

– Collateral or co-signers

– Bank statements or financial records

Your injury claim’s merit determines approval, not your personal financial situation.

The Application Process for Legal Funding

Getting pre-settlement funding is simpler than applying for traditional settlement loans:

Step 1: Submit Your Funding Application

Complete our streamlined application with basic information about your personal injury case and attorney details.

Step 2: Attorney Collaboration

We work directly with your personal injury attorney to review case documents and assess settlement potential.

Step 3: Quick Approval Decision

Most funding applications receive approval decisions within 24 hours based on case strength and anticipated recovery.

Step 4: Receive Your Cash Advance

Once approved, funds are typically available within 24-48 hours via direct deposit or check.

Step 5: Focus on Recovery

Use your pre-settlement loan funds for medical expenses, living expenses, or any other needs while your attorney handles your case.

Using Your Personal Injury Settlement Advance

Your cash advances can cover various expenses during your legal battle:

Medical Expenses and Treatment

Continue necessary medical treatment without worrying about upfront costs. Many injury victims delay care due to financial constraints, potentially harming both their health and their personal injury claim.

Living Expenses and Daily Needs

Cover rent, mortgage payments, utilities, groceries, and other essential living expenses while unable to work due to your injuries.

Transportation and Mobility

Pay for vehicle repairs, medical appointments, or alternative transportation if your injury affects your mobility.

Legal Costs and Case Development

While attorney fees are typically contingency-based, some case expenses like expert witnesses or medical records may require upfront payment.

Family Support

If you’re the primary breadwinner, your injury lawsuit funding can help maintain your family’s standard of living during recovery.

Advantages Over Traditional Financing

Personal injury loans offer significant benefits compared to conventional financing options:

No Risk of Default

Traditional loans require monthly payments regardless of your ability to pay. With pre-settlement funding, you only pay back if your personal injury lawsuit succeeds.

No Credit Impact

Conventional loan companies report to credit bureaus, potentially affecting your credit score. Our legal funding doesn’t impact your credit rating.

No Collateral Requirements

Traditional secured loans require collateral like your home or car. Our cash advances are secured only by your injury claim.

Faster Approval Process

Bank loans can take weeks or months for approval. Our lawsuit funding company typically approves applications within hours.

Flexible Repayment Terms

Traditional loans have fixed repayment schedules. You only pay back our advance when your case settles, with no predetermined timeline.

TESTIMONIALS

Real Stories, Real Results

Clients trust us for financial relief during settlement waits. Here’s their feedback:

Jason T.

Show More

Linda M.

Show More

Robert S.

Show More

Jason T.

“After my car accident, I was out of work and struggling with bills. This funding helped me stay afloat until my settlement came through.”

Linda M.

“Slipped and fell at a store and had to go through surgery. The insurance company dragged their feet, but this funding gave me breathing room.”

Robert S.

“Got injured on a construction site and couldn’t work. The financial relief I received made a world of difference for my family.”

Frequently Asked Questions About Personal Injury Funding

How quickly can I get cash advances?

Most clients receive funds within 24-48 hours after approval. Emergency situations may qualify for same-day funding.

What’s the maximum funding amount available?

Funding amounts typically range from $500 to $100,000+ based on your anticipated lawsuit settlement value and case strength.

Do I need perfect credit to qualify for pre-settlement funding?

No. Our lawsuit funding companies approve applications based on case merit, not credit scores or financial history.

What happens if I lose my case?

You owe nothing. Our legal funding is non-recourse, meaning repayment depends entirely on winning your personal injury lawsuit.

Can I get additional cash advances as my case progresses?

Yes, additional pre-settlement funding may be available as your case develops and settlement value increases.

How do I use the money from my personal injury loan?

The funds are yours to use however needed – medical bills, living expenses, transportation, or any other costs.

Will this affect my relationship with my personal injury attorney?

No. We work collaboratively with your attorney and never interfere with legal strategy or settlement negotiations.

Are there restrictions on case types eligible for funding?

We fund most personal injury claims, including car accidents, slip and falls, medical malpractice, workplace injuries, and wrongful death cases.

How are fees calculated for settlement loans?

Fees are typically calculated as a percentage of the advance amount and vary based on case duration and complexity.

What documents do I need for my funding application?

Basic case information and attorney contact details are usually sufficient to begin the application process.

Don’t let financial pressure force you to settle for less than you deserve. Get the personal injury funding you need to fight for full compensation while maintaining financial stability during your legal battle.