Class Action Lawsuit Loans: Fast Financial Relief for Group Litigation Cases

When you're part of a class action lawsuit, bills don’t stop coming while your case is pending.

Pre settlement loans for class action cases can provide the immediate financial relief you need-without the risk of traditional loans.

DiamondBack Funding specializes in class action lawsuit funding that helps you cover essential expenses without compromising your case or your future.

When you’re part of a class action lawsuit, the wait for your settlement can feel endless. Bills don’t stop coming just because your case is pending, and financial stress can mount quickly. If you’re struggling to make ends meet while waiting for your class action settlement, pre settlement loans for class action cases can provide the immediate financial relief you need—without the risk of traditional loans.

Class action lawsuits often take years to resolve, leaving plaintiffs in difficult financial positions. Whether you’ve been harmed by a defective product, pharmaceutical drug, data breach, or consumer fraud, you deserve financial stability while pursuing justice. DiamondBack Funding specializes in class action lawsuit funding that helps you cover essential expenses without compromising your case or your future.

Don’t let financial hardship force you into an unfair settlement. Contact DiamondBack Funding today for a free consultation and discover how our non-recourse class action funding can provide the support you need during this challenging time.

What Is a Class Action Lawsuit Loan?

A class action lawsuit loan—more accurately called class action settlement funding or a cash advance—is a non-recourse financial arrangement that provides you with immediate cash against your anticipated settlement proceeds. Unlike traditional loans from banks or credit cards, this funding doesn’t require monthly payments, credit checks, or employment verification.

Here’s what makes class action cash advance funding fundamentally different from conventional loans:

Non-Recourse Protection

If your case doesn’t result in a settlement or you lose at trial, you owe nothing. The funding company assumes all the risk, not you. This critical protection means you’re never personally liable for repayment if your case is unsuccessful.

No Monthly Payments

You don’t make any payments during your case. Repayment occurs only when your case settles, and the amount is deducted directly from your settlement proceeds by your attorney.

Case-Based Approval

Your approval depends entirely on your case’s strength and potential settlement value—not your credit score, income, or employment status. This makes group litigation funding accessible even if you’ve experienced financial difficulties.

Flexible Use of Funds

You can use your advance for any purpose—rent, mortgage payments, medical bills, utilities, groceries, car payments, or any other essential expenses. There are no restrictions on how you spend the money.

Class action cases present unique funding considerations because individual settlement amounts may be modest even when the total settlement reaches millions or billions of dollars. When a $500 million settlement is divided among hundreds of thousands of class members, individual awards might range from a few hundred to several thousand dollars. Mass tort settlement loans bridge this gap, providing financial stability during the extended litigation timeline while ensuring you receive fair compensation.

How Does Class Action Pre-Settlement Funding Work?

Understanding the class action settlement advance process helps you make informed decisions about whether this funding option is right for your situation. The process is straightforward and designed to minimize burden on you during an already stressful time.

Step 1: Initial Application

You begin by submitting a simple application to DiamondBack Funding, which takes approximately 10-15 minutes. You’ll provide basic information including:

- Your name and contact information

- Details about your class action case

- Your attorney’s name and contact information

- Approximate date you joined the class action

- Expected settlement timeline (if known)

- Estimated settlement value

This initial application can be completed online, by phone, or in person at our offices. There’s no cost to apply, and submitting an application doesn’t obligate you to accept funding.

Step 2: Case Documentation Review

Once we receive your application, DiamondBack Funding contacts your attorney to request detailed case documentation. Your attorney provides:

- Class action certification documents

- Evidence of your membership in the certified class

- Settlement demand information

- Litigation status updates

- Comparable settlement data for similar cases

- Expected timeline for settlement approval and distribution

This documentation allows our underwriting team to accurately assess your case’s strength and potential settlement value. Your attorney’s cooperation is essential, which is why we maintain strong relationships with law firms across the United States.

Step 3: Fast Underwriting Decision

Our experienced underwriters evaluate your case typically within 24-48 hours of receiving complete documentation. We assess:

- The strength of liability evidence against the defendant

- The stage of litigation and proximity to settlement

- Comparable settlements in similar class actions

- The defendant’s ability to pay the settlement

- Jurisdiction-specific factors affecting settlement values

- Your anticipated individual settlement amount

DiamondBack Funding’s advanced technology and experienced team enable faster decisions than many competitors, getting you the funds you need without unnecessary delays.

Step 4: Transparent Funding Offer

If approved, you receive a clear, written funding offer detailing:

- The advance amount you’ll receive

- The simple interest rate (we never use compound interest)

- All applicable fees with complete transparency

- Total repayment amount at various timeframes

- Expected repayment process when your case settles

- Your right to cancel within the state-mandated period

We believe in complete transparency. You’ll understand exactly what you’re agreeing to before signing any contract, with no hidden fees or surprise charges.

Step 5: Quick Fund Disbursement

After you and your attorney review and sign the funding agreement, DiamondBack Funding disburses your funds rapidly—typically within 24-48 hours. Funds are transferred directly to your bank account via secure electronic transfer, giving you immediate access to the financial relief you need.

Step 6: Repayment at Settlement

When your class action case settles and you receive your settlement distribution, your attorney deducts DiamondBack Funding’s repayment amount directly from your proceeds before distributing the remaining funds to you. You never have to worry about making payments or managing the repayment process—your attorney handles everything.

Ready to get started? Apply now for your defective product lawsuit loan or class action funding, and experience the DiamondBack Funding difference with our transparent, client-focused approach.

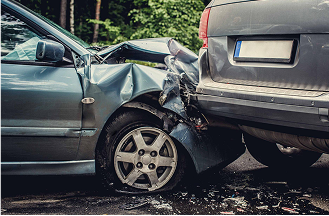

ACCIDENTS LAWSUITS & LIABILITY CLAIMS

Protect Your Rights, Secure Your Future

Accidents occur instantly, but their impact lasts a lifetime.

Negligence by others enables victims to pursue compensation through lawsuits and liability claims.

Legal actions help injured individuals secure compensation for medical costs, lost wages, and pain. However, insurance companies often delay or dispute claims, highlighting the need for strong legal representation to ensure fair outcomes.

Why You Need a Lawyer?

Filing a personal injury lawsuit requires legal expertise. An attorney helps:

Prove liability

Establishing who is at fault and collecting the necessary evidence.

Negotiate with insurance companies

Insurers often delay or minimize settlements to protect their profits.

Fight for maximum compensation

Your case shapes your eligibility, not your score.

We are the clear choice

Not all pre-settlement funding companies operate with your best interest in mind.

While many focus on quick cash advances, we prioritize fairness, transparency, and a process designed for your peace of mind. Unlike others, we:

- Offer low, transparent rates with no hidden fees.

- Provide non-recourse funding, meaning you only repay if you win your case.

- Approve funding quickly, often within 24 hours.

- Work directly with your attorney to ensure a seamless experience.

When life takes a wrong turn, we help you get back on track

We offer pre-settlement funding for personal injury claims, helping plaintiffs stay financially secure as they wait for a fair settlement.

Funding allocated for various types of cases, including:

Motor Vehicle Accidents

Show more

Pre-settlement funding for personal injury cases provides immediate financial relief, covering essential expenses, rent, and even medical treatments.

With financial stability, injured drivers and passengers can focus on recovery while their legal team fights for fair compensation without pressure to accept low settlement offers.

Slip & Fall & Premises Liability

Show more

Premises liability cases involve intricate legal disputes that require proving negligence.

Cash advances for slip and fall lawsuits provide financial assistance during resolution. This support alleviates financial strain, allowing injured victims to seek justice without the pressure of settling prematurely due to financial concerns.

Workplace & Construction Accidents

Show more

Workplace accident funding helps injured employees stay financially stable while their legal case progresses. Covering expenses and daily necessities, this support ensures that victims can recover without the added pressure of mounting bills. Since repayment is only required if the case is won, applicants can focus on their health and legal rights with peace of mind.

Take the first step toward financial relief—apply now!

Why Choose DiamondBack Funding for Class Action Cases?

When you’re navigating the complex world of non-recourse class action funding, choosing the right funding partner makes all the difference. DiamondBack Funding stands apart from other providers through our commitment to transparency, speed, and exceptional client service.

Lightning-Fast Approval and Funding

Time matters when you’re facing financial hardship. DiamondBack Funding leverages advanced technology and streamlined processes to deliver:

- Application review within 24 hours in most cases

- Funding decisions within 24-48 hours of receiving attorney documentation

- Fund disbursement within 24-48 hours after contract execution

- Same-day funding available for qualifying applicants in urgent situations

Our efficient process means you get the financial relief you need quickly, without the weeks of waiting that some funding companies require.

Transparent Fee Structure with No Hidden Costs

Many funding companies obscure their true costs through complicated fee structures, compound interest calculations, and hidden charges. DiamondBack Funding operates differently:

- Simple interest only—never compound interest that balloons over time

- Clear disclosure of all fees before you commit

- No application fees, processing fees, or hidden charges

- Straightforward contracts written in plain language you can understand

- Competitive rates that reflect your case’s specific circumstances

We believe you deserve to know exactly what you’re paying for funding, with no surprises when your case settles.

Exceptional Customer Service with Dedicated Case Managers

At DiamondBack Funding, you’re never just a case number. When you work with us, you receive:

- A dedicated case manager who knows your situation and remains your point of contact

- Responsive communication—we return calls and emails promptly

- Regular updates on your funding status throughout the process

- Respectful, compassionate treatment during a difficult time

- Answers to all your questions in clear, jargon-free language

Our team understands the stress you’re experiencing, and we’re committed to making the funding process as smooth and supportive as possible.

No Credit Check Requirements

Your credit history doesn’t determine your eligibility for class action lawsuit funding with DiamondBack Funding. We evaluate your case’s merits, not your credit score. This means:

- Approval even if you have poor credit or past financial difficulties

- No impact on your credit score from applying or receiving funding

- Accessibility for plaintiffs who can’t qualify for traditional loans

- Fair evaluation based solely on your case’s strength and settlement potential

No Monthly Payments—Ever

Unlike traditional loans that require monthly payments regardless of your financial situation, DiamondBack Funding’s class action settlement funding requires zero monthly payments. You repay only when your case settles, and only if your case settles successfully. This structure eliminates the stress of managing monthly payment obligations during an already challenging time.

Repayment Only If You Win

The non-recourse nature of our funding means you’re completely protected if your case doesn’t result in a settlement. If you don’t recover compensation, you don’t repay anything. DiamondBack Funding assumes the risk, not you—ensuring you can pursue justice without fear of additional financial burden.

Experience the DiamondBack Funding advantage. Contact us today to speak with a funding specialist who can answer your questions and help you determine if class action funding is right for your situation.

Common Expenses Covered with Class Action Loans

Mass tort settlement loans and class action funding provide flexible financial support that you can use for any legitimate expense. Plaintiffs in class action cases use their funding advances to address a wide range of financial needs during the extended litigation timeline.

Housing and Rent Payments

Maintaining stable housing is critical during litigation. Class action funding helps you:

- Pay monthly rent to avoid eviction

- Make mortgage payments to prevent foreclosure

- Cover property taxes and homeowners insurance

- Address necessary home repairs that can’t wait

- Pay security deposits if you need to relocate

Losing your home creates cascading problems that extend far beyond the immediate lawsuit. Class action cash advance funding protects your housing stability while your case progresses.

Medical Expenses and Healthcare Costs

Many class action plaintiffs face ongoing medical needs related to their injuries or the harm they suffered. Funding can cover:

- Doctor visits and specialist consultations

- Prescription medications and medical supplies

- Physical therapy and rehabilitation services

- Medical equipment and assistive devices

- Health insurance premiums to maintain coverage

- Out-of-pocket costs not covered by insurance

Delaying necessary medical care can worsen your condition and potentially harm your case. Funding ensures you receive the treatment you need without compromise.

Utilities and Essential Services

Basic utilities are non-negotiable for maintaining a safe, functional household. Use your funding for:

- Electricity and gas bills

- Water and sewer services

- Internet and phone service

- Trash collection and other municipal services

Utility disconnections create immediate crises affecting your family’s health, safety, and ability to function. Defective product lawsuit loan funding prevents these disruptions.

Transportation and Vehicle Expenses

Reliable transportation is essential for medical appointments, attorney meetings, and daily life. Funding helps with:

- Car payments to prevent repossession

- Auto insurance premiums

- Vehicle repairs and maintenance

- Fuel costs

- Public transportation expenses

Losing your vehicle can make it impossible to attend medical appointments or meet with your attorney, potentially harming your case outcome.

Daily Living Expenses

Class action funding provides support for basic necessities including:

- Groceries and food

- Clothing and personal care items

- Childcare and dependent care expenses

- School expenses for children

- Pet care and veterinary bills

When you’re unable to work due to injuries or other circumstances related to your case, these everyday expenses become overwhelming. Funding bridges the gap between your current financial reality and your future settlement.

Debt Payments and Financial Obligations

Preventing debt from spiraling out of control protects your long-term financial health. Use funding to:

- Make minimum credit card payments to avoid default

- Pay student loans to prevent default and credit damage

- Address past-due bills and collection accounts

- Prevent judgments and wage garnishments

Legal Fees and Case-Related Costs

While most class action attorneys work on contingency, some case-related expenses may fall to you:

- Expert witness fees in certain circumstances

- Court filing fees if applicable

- Document copying and administrative costs

- Travel expenses for depositions or court appearances

The flexibility of class action funding means you decide how to use the money based on your unique circumstances and most pressing needs. Contact DiamondBack Funding today to discuss how much funding you may qualify for based on your specific case.

Who Qualifies for Class Action Settlement Funding?

Understanding the eligibility requirements for non-recourse class action funding helps you determine whether you’re likely to qualify. DiamondBack Funding has straightforward qualification criteria designed to make funding accessible to legitimate class action plaintiffs.

Active Class Membership

You must be an active, verified member of a certified class action lawsuit. This means:

- You’ve officially joined the class action through proper opt-in procedures, or

- You’re automatically included as a class member based on the class definition, and

- You haven’t opted out of the class action settlement

- Your claim hasn’t been dismissed or disqualified

For mass tort cases that function similarly to class actions, you must have an active individual claim that’s part of the consolidated litigation. The case must be past the preliminary investigation stage with a formal complaint filed.

Attorney Representation

You must have legal representation by a licensed attorney who is actively handling your class action case. DiamondBack Funding requires attorney involvement because:

- Your attorney verifies your case status and class membership

- Your attorney provides the documentation needed for underwriting

- Your attorney coordinates repayment from settlement proceeds

- Your attorney protects your interests throughout the funding process

We do not provide funding to self-represented plaintiffs. If you’re part of a class action but don’t have an attorney, we can help connect you with qualified legal representation in appropriate cases.

Case Strength and Settlement Potential

Your case must demonstrate reasonable probability of successful settlement or verdict. DiamondBack Funding evaluates:

- Liability strength: Is there clear evidence the defendant caused harm?

- Damages documentation: Is there proof of injury or loss?

- Class certification status: Has the class been certified by a court?

- Settlement negotiations: Are settlement discussions progressing?

- Comparable settlements: Have similar cases resulted in favorable outcomes?

- Defendant’s financial capacity: Can the defendant pay a settlement?

Cases in early stages before class certification may face more stringent review, though funding may still be available depending on case specifics.

Sufficient Expected Settlement Value

Your anticipated individual settlement amount must be large enough to justify funding. While minimum amounts vary by case type and funder, DiamondBack Funding considers:

- The total class action settlement amount

- The number of class members sharing the settlement

- Your individual damages compared to other class members

- Whether you’re a named plaintiff with potentially higher recovery

- Comparable individual awards in similar class actions

Even if your expected individual settlement is modest, you may still qualify for funding. We evaluate each case individually rather than applying rigid minimum thresholds.

Case Types We Fund

DiamondBack Funding provides group litigation funding for a wide range of class action and mass tort cases, including:

Product Liability Class Actions

– Defective medical devices (hernia mesh, IVC filters, hip implants)

– Dangerous pharmaceutical drugs (Zantac, opioids, blood thinners)

– Defective consumer products (electronics, appliances, vehicles)

– Toxic exposure (talcum powder, Roundup, PFAS chemicals)

Consumer Fraud and Privacy Violations

– Data breach class actions

– False advertising and deceptive marketing

– Unfair business practices

– Privacy violations and unauthorized data collection

– Identity theft resulting from corporate negligence

Employment Class Actions

– Wage and hour violations

– Unpaid overtime claims

– Misclassification of employees as independent contractors

– Discrimination and harassment

– Wrongful termination affecting multiple employees

Environmental and Toxic Tort Cases

– Water contamination (Camp Lejeune, Flint)

– Air pollution and emissions

– Chemical exposure

– Environmental disasters affecting communities

Securities Fraud and Financial Class Actions

– Shareholder class actions

– Investment fraud affecting multiple investors

– Retirement plan mismanagement

What You Don't Need to Qualify

DiamondBack Funding’s approval process focuses on your case, not your personal financial situation. You don’t need:

- Good credit or any credit history

- Current employment or income

- Collateral or assets

- Co-signers or guarantors

- Bank account history or financial statements

Find out if you qualify in minutes. Contact DiamondBack Funding today for a free, no-obligation consultation about your class action settlement advance eligibility.

How to Apply for a Class Action Loan

Applying for pre settlement loans for class action cases with DiamondBack Funding is simple, fast, and completely free. Our streamlined application process is designed to minimize your time investment while gathering the information needed to evaluate your case.

Step 1: Complete Our Simple Online Application

Visit DiamondBack Funding’s website and complete our brief online application form, which takes approximately 10-15 minutes. You’ll provide:

- Your full name and contact information (phone, email, address)

- Your attorney’s name, law firm, and contact information

- Basic information about your class action case

- The type of harm or injury involved

- Approximate date you joined the class action

- Your estimated settlement amount (if known)

- How much funding you’re seeking

Alternatively, you can apply by calling our office directly to speak with a funding specialist who will gather this information over the phone. If you prefer in-person applications, contact us to schedule an appointment at one of our convenient locations.

Step 2: Attorney Documentation

After receiving your application, DiamondBack Funding contacts your attorney to request case documentation. Your attorney provides:

- Verification of your class membership

- Class action certification documents

- Litigation status and timeline updates

- Settlement negotiation information (if applicable)

- Comparable settlement data

- Your expected individual settlement amount

This step typically occurs within 24 hours of your initial application. Most attorneys are familiar with the pre-settlement funding process and can provide documentation quickly. If your attorney has questions, our team is available to explain the process and address any concerns.

Step 3: Rapid Underwriting Review

DiamondBack Funding’s experienced underwriting team reviews your case documentation, typically completing the evaluation within 24-48 hours. Our underwriters assess:

- Your case’s strength and likelihood of favorable settlement

- Your expected settlement timeline

- Your anticipated individual settlement amount

- Comparable outcomes in similar class actions

- Any jurisdiction-specific factors affecting your case

Our advanced technology and streamlined processes enable faster decisions than many competitors, getting you answers quickly.

Step 4: Receive Your Funding Offer

If approved, you’ll receive a clear, written funding offer via email or mail (based on your preference). Your offer includes:

- The approved funding amount

- The simple interest rate applicable to your advance

- A complete breakdown of all fees

- Total repayment amounts at various timeframes

- All terms and conditions in plain language

- Your cancellation rights under state law

Take time to review the offer carefully with your attorney. Ask questions about anything you don’t understand—our team is here to ensure you’re completely comfortable with the terms before proceeding.

Step 5: Sign Your Agreement

If you decide to accept the funding offer, you’ll sign the funding agreement electronically through our secure digital signature system. The entire signing process takes just minutes and can be completed from your computer or smartphone.

Your attorney also reviews and acknowledges the agreement, confirming their understanding of the repayment process when your case settles.

Step 6: Receive Your Funds

After contract execution, DiamondBack Funding disburses your funds rapidly—typically within 24-48 hours. Funds are transferred directly to your bank account via secure electronic transfer (ACH). You’ll receive confirmation when the transfer is initiated and when funds are available in your account.

In urgent situations, same-day funding may be available for qualifying applicants. Contact us to discuss expedited processing if you’re facing an immediate financial emergency.

What Happens Next?

After receiving your funding, you simply continue with your life and your case. There are no monthly payments, no check-ins, and no ongoing obligations. When your class action case settles:

- Your attorney receives your settlement distribution

- Your attorney deducts DiamondBack Funding’s repayment amount

- Your attorney distributes the remaining settlement proceeds to you

- DiamondBack Funding sends you a final statement confirming repayment

The entire repayment process is handled by your attorney—you don’t need to do anything.

Ready to take the first step toward financial relief? Apply now for your class action lawsuit funding with DiamondBack Funding, or call us to speak with a funding specialist who can answer your questions and guide you through the process.

Understanding the Benefits of Non-Recourse Funding

The non-recourse structure of class action settlement funding provides unique advantages that traditional financing simply cannot match. Understanding these benefits helps you make informed decisions about your financial options during litigation.

Complete Financial Protection

With non-recourse funding, you’re protected from financial loss if your case doesn’t succeed. Traditional loans require repayment regardless of your circumstances, potentially leaving you in worse financial condition than before. Non-recourse class action funding eliminates this risk entirely—if you don’t win, you don’t pay.

No Impact on Credit or Employment

Because approval is based solely on your case merits, your credit score remains unaffected throughout the process. There are no credit inquiries, no monthly payment obligations that could lead to defaults, and no risk of damaging your credit if your case takes longer than expected.

Flexibility During Uncertain Times

Class action litigation timelines are notoriously unpredictable. Settlement negotiations can stall, court dates can be postponed, and cases can take unexpected turns. Class action cash advance funding provides financial stability regardless of these uncertainties, allowing you to maintain your quality of life without compromising your case strategy.

Leveling the Playing Field

Large corporations and insurance companies have virtually unlimited resources to wait out plaintiffs who are struggling financially. They often use delay tactics hoping you’ll accept a lowball settlement out of desperation. Access to group litigation funding ensures you can hold out for fair compensation rather than settling prematurely due to financial pressure.

TESTIMONIALS

Real Stories, Real Results

Clients trust us for financial relief during settlement waits. Here’s their feedback:

Jason T

Show More

Linda M.

Show More

Robert S.

Show More

Frequently Asked Questions About Class Action Funding

How much can I borrow against my class action settlement?

The amount you can receive through class action settlement funding depends on your expected individual settlement value. DiamondBack Funding typically advances 10-20% of your anticipated settlement amount, though this can vary based on case strength, timeline, and specific circumstances. For example, if your expected settlement is $50,000, you might qualify for $5,000-$10,000 in funding. Named plaintiffs with potentially higher settlements may qualify for larger advances. Contact us for a personalized evaluation of your funding eligibility.

What if my class action case loses or doesn’t settle?

Because DiamondBack Funding provides non-recourse advances, you owe nothing if your case doesn’t result in a settlement or favorable verdict. We assume all the risk—if you don’t recover compensation, you don’t repay the advance. This protection ensures you can pursue justice without fear of additional financial burden if your case is unsuccessful.

How long does the application and approval process take?

Most applicants receive funding decisions within 24-48 hours of submitting complete case documentation through their attorney. The entire process from initial application through fund receipt typically takes 3-5 business days in straightforward cases. Expedited processing is available in urgent situations, with same-day funding possible for qualifying applicants.

Will applying for funding affect my credit score?

No. DiamondBack Funding does not check your credit, and applying for or receiving non-recourse class action funding has zero impact on your credit score. Our approval decisions are based entirely on your case’s merits, not your personal financial history or creditworthiness.

Can I get funding if I have bad credit or no income?

Yes. Your credit history and employment status don’t affect your eligibility for class action funding. We evaluate your case’s strength and settlement potential, not your personal finances. This makes funding accessible even if you’ve experienced financial difficulties, unemployment, or credit challenges.

What interest rates does DiamondBack Funding charge?

Interest rates for class action cash advance funding vary based on case-specific factors including case strength, expected timeline, and funding amount. DiamondBack Funding uses simple interest only—never compound interest that escalates over time. We provide complete rate disclosure before you commit, ensuring you understand exactly what you’ll repay when your case settles. Contact us for a personalized rate quote based on your specific case.

Are there any hidden fees?

No. DiamondBack Funding believes in complete transparency. All fees are clearly disclosed in writing before you sign any agreement. We never charge hidden fees, surprise charges, or undisclosed costs. What you see in your funding offer is exactly what you’ll pay—nothing more.

How is repayment handled when my case settles?

Repayment is simple and automatic. When your class action settles and you receive your distribution, your attorney deducts DiamondBack Funding’s repayment amount directly from your settlement proceeds before distributing the remaining funds to you. You don’t make any payments directly—your attorney handles the entire repayment process as part of the settlement distribution.

Can I get additional funding if my case takes longer than expected?

Yes. If your case extends beyond your initial expectations and you need additional financial support, you may qualify for supplemental funding. DiamondBack Funding can provide additional advances based on updated case evaluations and your remaining expected settlement value. Contact your case manager to discuss additional funding options.

What if I change my mind after receiving funding?

Most states provide a cancellation period (typically 5 business days) during which you can cancel your funding agreement without penalty. If you cancel within this window, you simply return the funding amount and owe nothing additional. Specific cancellation rights vary by state—your funding agreement clearly explains your cancellation rights under applicable state law.

Does my attorney need to approve the funding?

While your attorney doesn’t need to formally approve your decision to seek funding, attorney cooperation is essential for the process. Your attorney must provide case documentation for underwriting and must acknowledge the funding agreement to coordinate repayment from settlement proceeds. Most attorneys are familiar with pre-settlement funding and support clients’ decisions to seek financial assistance during litigation.

What types of class action cases does DiamondBack Funding support?

DiamondBack Funding provides mass tort settlement loans and class action funding across a wide range of case types, including product liability (defective drugs, medical devices, consumer products), consumer fraud and privacy violations (data breaches, false advertising), employment class actions (wage and hour violations, discrimination), environmental torts (water contamination, toxic exposure), and securities fraud. Contact us to discuss your specific case type.

How does DiamondBack Funding differ from other funding companies?

DiamondBack Funding stands apart through our commitment to transparency, speed, and exceptional client service. We offer simple interest rates (never compound interest), transparent fee structures with no hidden costs, rapid approval and funding (typically 24-48 hours), dedicated case managers for personalized service, and competitive rates that reflect your case’s specific circumstances. Our client-first approach ensures you receive the financial support you need with the respect and clarity you deserve.

Take Control of Your Financial Future Today

Don’t let financial hardship force you into an unfair settlement or prevent you from pursuing the justice you deserve. Class action lawsuits can take years to resolve, but your bills and expenses can’t wait. DiamondBack Funding’s pre settlement loans for class action cases provide the immediate financial relief you need with transparent terms, fast approval, and zero risk if your case doesn’t succeed.

Our streamlined process gets you the funds you need quickly—typically within 3-5 business days from application to funding. With no credit checks, no monthly payments, and no repayment obligation if your case is unsuccessful, you have nothing to lose and financial stability to gain.

Contact DiamondBack Funding now for a free, no-obligation consultation about your class action settlement funding options. Our experienced team is ready to answer your questions, evaluate your case, and provide the support you need during this challenging time. Apply online in minutes, or call us to speak with a funding specialist who can guide you through the process.

Whether you’re facing mounting medical bills, struggling to pay rent, or simply need help covering daily expenses while your case progresses, class action lawsuit funding from DiamondBack Funding provides the financial bridge you need. Our transparent approach, competitive rates, and commitment to exceptional service ensure you receive fair treatment and the support you deserve.

Your path to financial stability starts here. Apply now and experience the DiamondBack Funding difference.